#AskMelanie: What are the new rules for this upcoming tax season?

Heads up, Canadians: Due to the COVID-19 pandemic, this is going to be a tax season like no other. If you collected COVID-19-related benefit payments last year, you might end up owing more money than in previous years. Here’s what you need to know about filing your taxes this season, including important deadlines.

Has the deadline been extended?

Despite this being a more complex tax season, the Canada Revenue Agency (CRA) has not extended the tax filing deadline. The due date is still April 30 for most Canadians and June 15 for self-employed people.

To avoid interest charges, Canadians need to pay any taxes owed by April 30. However, not everyone has to comply with that rule this year.

Those who had a total taxable income of $75,000 or less and received one or more of the COVID-19 benefits listed below don’t have to pay their taxes until April 30, 2022.

Eligible benefits:

- Canada emergency response benefit (CERB).

- Canada emergency student benefit (CESB).

- Canada recovery benefit (CRB).

- Canada recovery caregiving benefit (CRCB).

- Canada recovery sickness benefit (CRSB).

- Employment Insurance benefits.

- Similar provincial emergency benefits.

READ MORE

You might also like: How can I claim my home office for a tax deduction as an employee?

My office is open and ready to serve you.

Hours are Monday, Tuesday, Thursday, and Friday 9:00 am-5:00 pm daily, evenings and weekends are possible by appointment only. I am excited to be reopened and look forward to meeting with clients in person. I am following recommended Covid-19 safety and cleaning protocols. Masks are required to enter the office and I also ask that each person sanitize their hands upon entry. I encourage clients to make appointments if they want to meet with me directly and so that I can manage the flow of individuals in the office at any one time. However, as detailed below, there are a few different ways to get your information to me safely if you do not need to meet.

I am accepting personal and corporate tax information in one of four ways:

- In-office – please see details above to drop off tax returns in-person;

- Via email – you can scan your documents and then send them to me in an email (preferably send everything in one email).

- Via a portal – I have a secure portal that I can invite you to. We can then share documents between us. This requires that you send me an email requesting the portal. I will then send you an invite to which you then accept and set up with your own password. We can then upload documents and receive notices whenever something changes.

- Mailbox drop-off – there is a mailbox at the back of the building to submit your documents in. It is a locked box that I check a few times a day.

When the tax return(s) are completed, I will be in touch with respect to delivery and pick up options.

Take care and stay safe. If we all work together, this will be over faster!

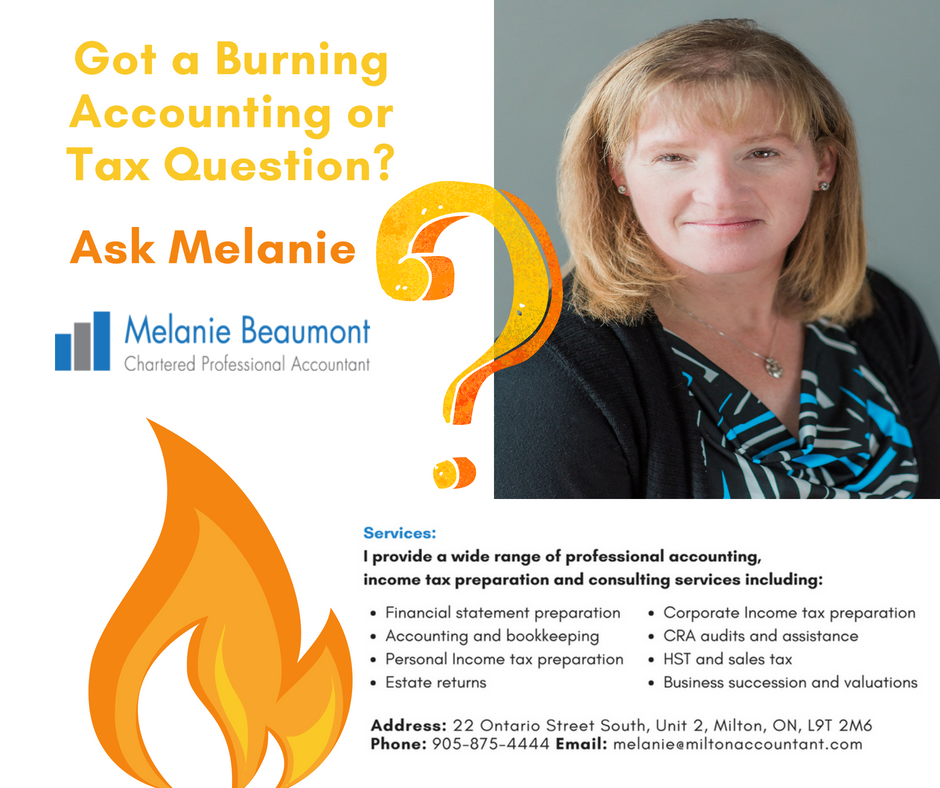

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an e-mail ✉ : Send me a messge at melanie@miltonaccountant.com

- Call ✆: Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well.

Leave a Reply

Want to join the discussion?Feel free to contribute!