#AskMelanie: Have you thought about your taxes and estate planning considerations?

Death is not a subject any of us want to think about but having important conversations with your family about their wishes (plus yours as well) and ensuring that if you are responsible for settling your estate being prepared is critical. This article will give you some important things to consider and also provides some additional tips for end of life planning. As my client, I ensure you stay on top of your important priorities. Each month in my #AskMelanie column, I address those burning questions so that you can maximize your time on growing your business and not worry about taxation issues. As a CPA accountant serving the Milton and GTA community, I am excited to have recently opened a bright and beautiful location in downtown Milton so please feel free to drop by and address your needs with me in-person.

#AskMelanie: Have you thought about your taxes and estate planning considerations?

#AskMelanie: Have you thought about your taxes and estate planning considerations?

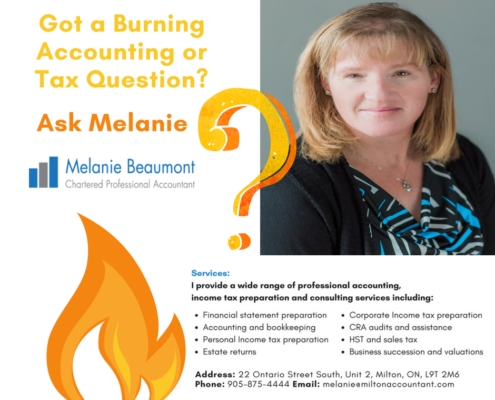

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!