#AskMelanie: How can I better organize my estate?

January is a great month for reviewing and cleaning up your finances. In addition to this, I am strongly urging all of my clients to have another individual authorized on their CRA account (preferably your accountant and also a spouse or the executor of their will). I have had many clients whose spouse has passed away and completing all the requirement of the estate is taking much longer than needed as they do not have access to the deceased tax account. Important note: Being identified as the executor in a will is not sufficient to allow you access to the individual’s CRA account. The CRA wants the returns filed, but will not talk to anyone without the authorization. CLICK HERE FOR THE FORM.

#AskMelanie: How can better organize my estate?

#AskMelanie: How can better organize my estate?

This Simple Tool Can Help Organize Your Estate (Content courtesy of the Bean Counter)

I have written numerous times over the years urging you, my readers, to get your financial affairs in order, by stress testing your finances should you pass away suddenly. While clearly a morbid topic, the rationale for the discussion is this: if you do not get your affairs in order and you pass away suddenly, you leave your family a financial mess at a time of emotional distress, anxiety and confusion.

I have had many readers personally write to thank me for urging them to undertake this task, since it provided them with financial peace of mind. They told me that in many cases, this undertaking was the catalyst for them to sit down with their spouse or significant other, review their finances, and communicate and document what financial assets they have and where they can go to find them. In addition, other non-financial issues surrounding their passing were discussed, such as funeral arrangements.

In my professional practice, I have practiced what I preached and have urged my clients to write their financial story and organize their affairs. As clients, I was able to provide them a fillable estate organizer to make their task somewhat easier.

You can link to the estate organizer and download the document here.

If you have not already taken the time to write your financial story and organize your estate, you now have no reason to procrastinate — you have a simple, fillable document to make the task much simpler.

WANT MORE TIPS DELIVERED TO YOUR INBOX? Subscribe to the #ASKMelanie column NOW

The content on this blog has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The blog cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact BDO Canada LLP to discuss these matters in the context of your particular circumstances. BDO Canada LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information on this blog or for any decision based on it.

Please note the blog posts are time sensitive and subject to changes in legislation.

BDO Canada LLP, a Canadian limited liability partnership, is a member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms.

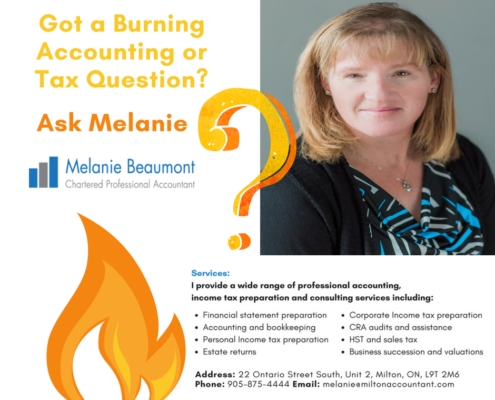

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!