#AskMelanie: Should I make personal income tax installments suggested by CRA?

Many of my clients come to me with really important questions that need an immediate answer. I never leave my clients hanging. Each month in my #AskMelanie column, I address those burning questions so that you can maximize your time on growing your business and not worry about taxation issues. As a CPA accountant serving the Milton and GTA community, I am excited to have recently opened a bright and beautiful location in downtown Milton so please feel free to drop by and address your needs with me in-person.

#AskMelanie: Should I make personal income tax installments suggested by CRA?

#AskMelanie: Should I make personal income tax installments suggested by CRA?

Based on your income tax returns filed for the past couple of years, if you owed more than $3,000 in this past taxation year, you may need to make installments towards the coming taxation year. Is that always the case ? Nope. Something on this year’s tax return may not re-occur in the next taxation year (for example the sale of a property) and so, your income may, in fact, be lower this coming year. You always have the option of calculating your own installments and should consult with your accountant.

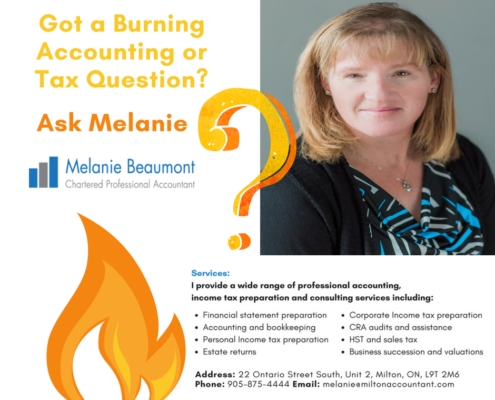

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business start ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!