#AskMelanie: How can I better manage and organize my accounting paperwork?

It is critical that I keep a well-organized office for my clients and for myself. I am often asked for tips on how to best organize important accounting paperwork. Having a system in place to manage your accounting paperwork is essential. I recommend scheduling time regularly to work on staying organized with your finances and paperwork so that you don’t miss out on important deductions as well as revenue projections. Here is a simple tip: Tracking your mileage is mandatory. Have you considered keeping a notebook to track mileage in your car or perhaps an app? Little systems make a big difference!

#AskMelanie:

#AskMelanie:

How can I better organize and manage my accounting paperwork?

Here are some great tips from Quickbooks:

1. Keep your personal and business bank accounts separate

This should include, credit cards as well. I recommend that each source of funding be reconciled on a regular basis to ensure everything is recorded and to save time at year end.

2. Avoid paying expenses or bills in cash wherever possible

Other than small amounts of petty cash, it’s best not to use cash for your business transactions. Expenses paid in cash can be difficult to track and reconciling cash outgoings with receipts can be tricky and time-consuming. Where you do have to use cash, reimburse the payer immediately using an expense form to ensure you accurately record all business transactions, VAT and any other service taxes that need to be captured. Unless there is a receipt attached to the expense report, cash paid transactions are not deductions. VISA BILLS ARE NOT SUFFICIENT PROOF OF AN EXPENSE. For example, If you are filling your gas tank you need to keep that little “chit” to support your purchase.

3. Create separate records for accounts payable and receivable

Having an accounts receivable system helps you track whether your customers have paid and how overdue unpaid accounts are, so you can chase up payments and keep your cash flow smooth throughout the month. It is also important to have a system in place for your accounts payable, which will help you ensure you aren’t duplicating or being late on your supplier payments.

4. Organize your paperwork digitally

Thanks to myriad accounting software out there today, you can say goodbye to manually filing and storing your receipts, invoices and other financial paperwork that’s integral to your business. Keeping your books digitally also means you can securely backup your files electronically instead of storing them physically on the office premises, which goes a long way in saving space and reducing the risk of losing important business information, as well as making your documents easily retrievable when you need them.

WANT MORE TIPS DELIVERED TO YOUR INBOX? Subscribe to the #ASKMelanie column NOW

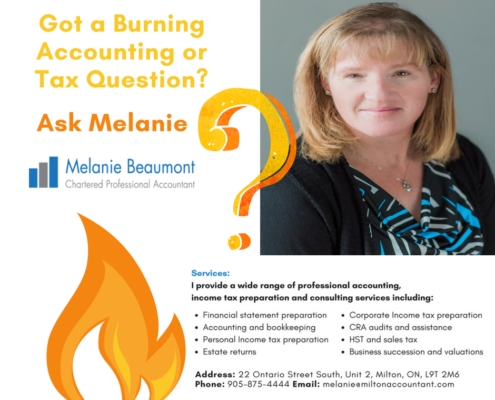

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!