#ASKMelanie: Top Questions answered about filing your pandemic taxes

Your taxes might look a little different this year because of the pandemic. With special government assistance like the Canada Emergency Response Benefit and new deductions for people who work from home, this tax season promises to be unique.

The Canada Revenue Agency says it is expecting a flood of queries related to COVID-19 benefits.

To help those with questions, personal finance expert Shannon Lee Simmons sat down virtually with CBC’s Jacqueline Hansen to discuss how taxes are different this year.

Here are those answers, edited for clarity and length.

Q: Tax season usually kicks off when you get that T4 form from employers. This year, there are different forms. Can you walk us through what other forms Canadians could be expecting?

A: If you got government support last year (whether through CERB, CRB, or CSB), that’s going to show up on a T4A. And the most important thing you can do for yourself is have a my CRA account. You can go to previous tax years; you can make sure you have all your tax slips and find all your T4 documents.

For home office workers — there’s also the T2200 form. The T4A for government support and the T2200 for home office expenses are the two new forms you should be watching out for.

We’re also used to seeing T4Es. Those are the Employment Insurance forms and used for parental leave as well. If you were an employee and you were laid off this year, Service Canada changed it so that across the board — everyone got $500 per week.

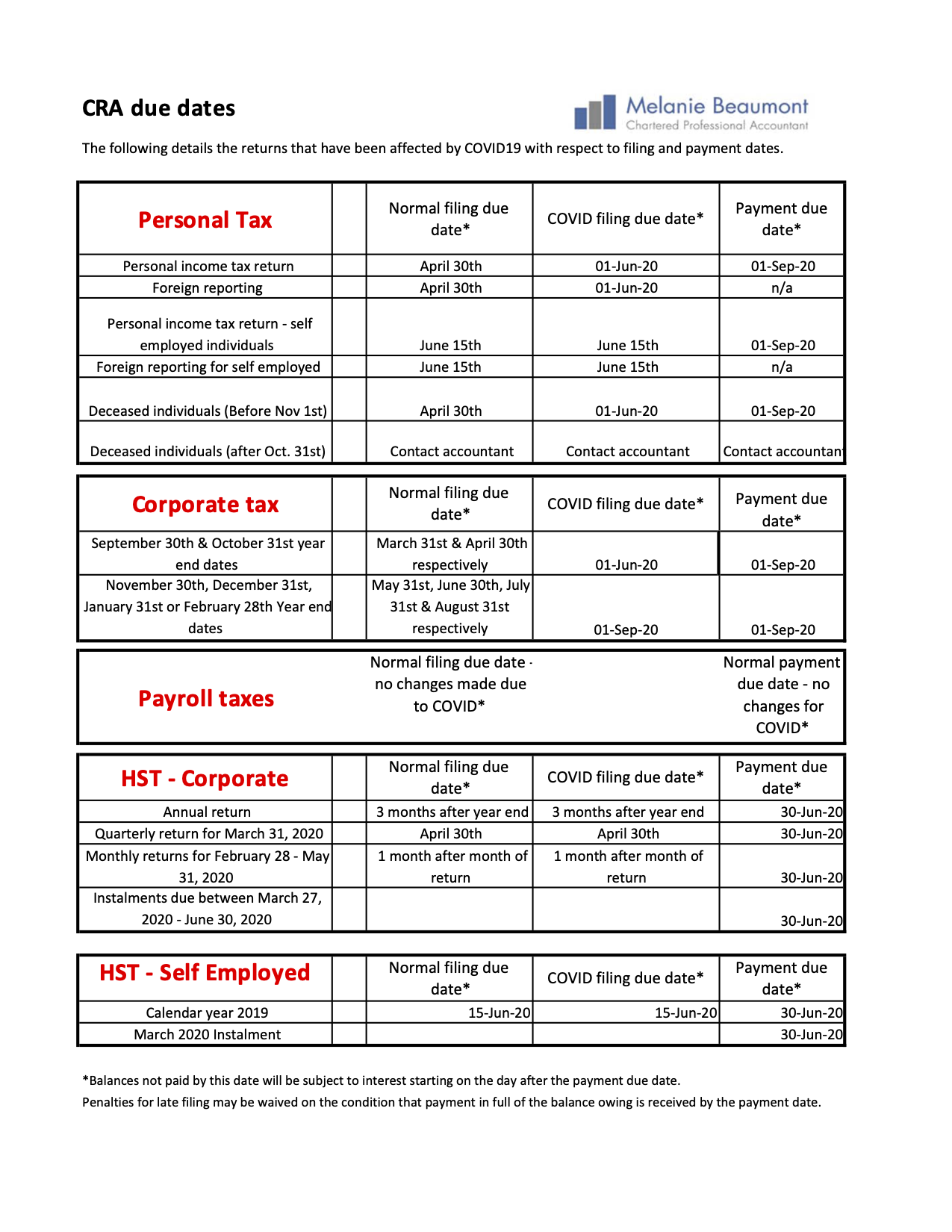

Q: A YouTube user asked: Are there any indications that the CRA will delay the return filing due dates (like they did last year) beyond April 30 for personal tax returns, and June 15 for corporations?

A: I didn’t see any indication of that. It’s really important to know: There’s a big difference between filing your taxes and paying any balances owing. The big deadline that everyone usually talks about is this April 30 filing deadline for personal taxes.

And it’s June 15 for people who are self-employed, which would be if you’re a sole proprietor. But I worry about people thinking that they have until June 15 to file their self-employment taxes because the money is still due April 30.

How can you know necessarily what you might owe by April 30 if you haven’t filed yet? Try to figure out what you owe and get it done by April 30. Because then you don’t get charged any interest — that’s my blanket advice.

Q: Who doesn’t have to pay right away? Who has a year to pay the taxes that they owe?

A: Very specifically: if you made $75,000 or less in 2020 and you were on one of the government programs (such as CRB, CSB, the caregiver allowance, or CERB), you have an amount outstanding. You have until April 30, 2022 to pay those taxes without the government charging you any interest.

If you made over $75,000, you don’t qualify for that extension.

Q: What should people do if they can’t get into the my CRA accounts?

A: The CRA shut down 800,000 Canadian accounts recently. So the best thing to do if that’s happening to you is just reset it. It’s going to be annoying. You’re going to have to get on the phone.

I’ve had some clients say that they waited three hours to get through, so put your phone on speaker and maybe watch a show or do some work. Eventually when they pick up, they’re going to need last year’s tax information. Hopefully you’ve got your Notice of Assessment handy but they do have a way of asking other security questions in case you don’t.

Note: The CRA also says users can log in using their banking information or have a new CRA registration mailed to them.

Q: Stephanie on YouTube asked: My T4 for CERB is on my CRA account but I haven’t got the physical copy in the mail yet. Can I use that electronic file in order to file my taxes?

A: 100 per cent. That’s what it’s there for.

Q: Margaret via Facebook asked: My boss laid me off last March and still has not supplied me with my T4. What do I do?

A: Legally, your employer has to file that T4 by Feb. 28 of this year. You may not have gotten a physical copy, but it may still be posted to your My CRA account. Check there first. It should be there, even if you haven’t gotten the physical copy, because sometimes employers will forget or they’ll be lazy or something will happen administratively for small businesses. That’s the easiest solution.

Number 2 would be to call your old employer, speak to the manager, speak to somebody and see if they have that information. Ask them: “What did they file to the CRA?” They should have filed it legally with the CRA already, so that is a bigger issue if they haven’t.

Q: Saba from Facebook asked: Can you write off a portion of property tax (when working from home) if you’re a homeowner?

A: No, not unless you’re an employee who earns commissions. The homeowner here really is not set up for the best bang for their buck as far as the “detailed method” (for calculating home-office expenses) goes.

For a lot of the clients I’ve seen, the flat rate tends to be easier, faster and worth more for a lot of people who are homeowners.

For the flat rate method, you just tally up how many days of your year that you were mandated to work from home (vacation days don’t count) and then make sure you do run that by your employer.

A lot of people are opting to do that, especially homeowners who work out their electricity, and their heat, and then once they take their time and square footage into account, it’s like well that’s only a $200 deduction.

Lee Simmons recommends checking out this calculator.

Q: Danny on Facebook asked: Is there anything different about this tax season that students need to know in particular?

A: Number one, if you’re a student and if you were on the Canada Student Benefit, it is considered taxable income. Just like CERB, it’s going to be treated the same way and you’re going to get a T-slip. So that’s something to watch out for.

However, as a student, you probably have tuition credits that are going to completely offset that.

So make sure that you’re applying those tuition credits and putting them in properly. And don’t forget to add any carry-forward tuition from previous years. The more tuition credits you have, the less tax you’re paying.

Q: This is a different year for parents. Are there any potential tax surprises for parents as typically child care would have been a big cost?

A: It’s a big change this year for parents. If you have child care, the typical amount if you have a child under seven — you can deduct up to $8,000 per kid. So keep in mind that most people are going to spend between $15,000-$20,000 per kid. And then to be able to write off $8,000 as a deduction is huge for families. If you’ve got two kids that would be a $16,000 deduction to your household.

It works the same as an RRSP deduction. Imagine you made a $16,000 RRSP contribution, it would have the same positive impact on your taxes.

This year, what I’m noticing is people may not have spent the full $8,000 because maybe for six months they weren’t paying child care or day camps weren’t running. So all the things that used to qualify for that now don’t; they may no longer have the full deduction amount. So that might be a surprise. But you also spent less, so remember, you were saving some money.

You might also like:

#AskMelanie: What are the new rules for this upcoming tax season?

My office is open and ready to serve you.

Hours are Monday, Tuesday, Thursday, and Friday 9:00 am-5:00 pm daily, evenings and weekends are possible by appointment only. I am excited to be reopened and look forward to meeting with clients in person. I am following recommended Covid-19 safety and cleaning protocols. Masks are required to enter the office and I also ask that each person sanitize their hands upon entry. I encourage clients to make appointments if they want to meet with me directly and so that I can manage the flow of individuals in the office at any one time. However, as detailed below, there are a few different ways to get your information to me safely if you do not need to meet.

I am accepting personal and corporate tax information in one of four ways:

- In-office – please see details above to drop off tax returns in-person;

- Via email – you can scan your documents and then send them to me in an email (preferably send everything in one email).

- Via a portal – I have a secure portal that I can invite you to. We can then share documents between us. This requires that you send me an email requesting the portal. I will then send you an invite to which you then accept and set up with your own password. We can then upload documents and receive notices whenever something changes.

- Mailbox drop-off – there is a mailbox at the back of the building to submit your documents in. It is a locked box that I check a few times a day.

When the tax return(s) are completed, I will be in touch with respect to delivery and pick up options.

Take care and stay safe. If we all work together, this will be over faster!

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an e-mail ✉ : Send me a messge at melanie@miltonaccountant.com

- Call ✆: Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well.