#AskMelanie: How can I change the way I feel about my financial future?

As an accountant, I have very candid and personal conversations around money and the stress it can cause my clients. Feeling a sense of control over our financial lives is something that we all strive for but how do we cope when things are less than perfect? Cash flow for business owners, the ever-growing expense of raising children and the lack of retirement security are things that many are struggling with today. It can cause us to feel inadequate and unsure of our futures.

The Financial Blind Spots survey, conducted by FPSC, found that four-in-10 Canadians (39%) feel they don’t have their financial future under control, while three-in-10 (29%) admit they are overwhelmed with their financial options.

Don’t suffer in silence, speak to me about ways you can take back control of your financial picture. I am always just a phone call or email away!

#AskMelanie: How can I change the way I feel about my financial future?

#AskMelanie: How can I change the way I feel about my financial future?

How much power do you feel you have over your money? Your happiness and financial well-being may depend on it, experts say.

People who think they have power over their finances are happier than those who think they have little power over their finances, a study from investment research company Morningstar found a couple of years ago. That result was true whether people’s incomes were high or low.

Newcomb offers tips to Money Talks News readers on taking control of what she calls your “personal economy.” A link to the complete article can be found here.

1. Focus on your thinking

Concentrate on how you think about your financial situation, rather than just tediously listing your income and expenses on an app to see if your cash flow is out of whack.

“Why do I need apps to tell me I’m broke if I’m disempowered?” she says. “Focus on your thinking.”

Once you start to think differently, you will behave differently, Newcomb says. “We have the power.”

2. List the things you can — and cannot — control

Thinking about the power you have can naturally improve your sense of financial well-being, Newcomb says.

On the other hand, there are things you might not be able to control. In the short-term, maybe you can’t change your salary, rent or mortgage, or other bills, Newcomb says.

You also might not be able to control:

- Dependents: If you care for children or parents, you cannot control the fact that this will put a drain on your resources.

- Geography: Maybe you can’t move, which may affect your cost of living as well as the job opportunities available.

- Time: Maybe you can’t always make your schedule perfect. Like everyone else, you’re limited to 24-hour days.

- Other people: You can’t control your spouse’s priorities, salary or habits.

While these things are out of your control now, focus on how that might change over time.

“In the long term, almost everything is changeable if you have a plan, and you invest in making the changes necessary to adjust your life to better suit you,” she says. “That’s the purpose of the exercise: When you try to think about what you can’t control, you may find that you really can do more to change your situation than you thought.”

3. Put time on your side

Most of us don’t save because “we’re not wired for it,” Newcomb says.

Newcomb explains in her book that going for the immediate reward instead of focusing on long-term goals — known as “discounting the future” — is responsible for many types of goal-defeating behaviors such as procrastination, drug addiction, impulsive shopping and failure to save money for the future.

So, you need to change your natural inclination to spend by creating a plan to save. To begin, ask yourself how far ahead you think about money: A week? A month? Five years?

One study revealed a connection between how far ahead people think and how much money they have saved.

On average, people earning $50,000 a year who looked far ahead — like to retirement — saved more dollars than those making $100,000 who didn’t look far ahead, Newcomb says.

You can train yourself to extend your time horizon, she says:

- If you need inspiration, look at yourself through online age-progression software that will use a picture of you now to generate what you may look like in 20 years.

- Write a detailed essay visualizing the details of your retirement: Where will you live — city, suburb, countryside? How will you spend your time? Who will you spend your time with?

- If you typically only look ahead a month or two, create a one-year plan and put it in place starting in 2019. Once you have the one-year plan, try making a three-year plan; or if you have a three-year plan, go for five.

If you train your imagination to see a bit further into the future, you will save more money over time, Newcomb says. Otherwise, you will be at a higher risk for a higher debt-to-income ratio, lower savings rate, and more impulsive spending.

“It doesn’t cost more to think ahead,” Newcomb says.

4. Celebrate your victories

Feeling powerful when you’re in debt can be difficult. So, change the story you’re telling yourself, Newcomb says.

For example, paying down $1,000 on a credit card might feel less like “getting ahead” and more like just filling a hole. “Money feels like it’s gone, and that feels disempowering,” Newcomb says.

Instead, she suggests taking a more positive approach: Think of how you’ve just increased your net worth, plus avoided future interest payments on the $1,000.

Taking joy and pride in your victories is one key to feeling more in control of your finances.

“Celebrate every positive thing, like ‘Are you doing better than last year?’ ” Newcomb says. “Did you feed your kids today? Good, celebrate that. A lot of people can’t.”

And don’t worry about what other people have that you don’t. “The person carrying a Louis Vuitton purse, you don’t know if she’s crying in the shower over her credit card bill,” Newcomb says.

6. Enjoy your positive payoff

Money is a major cause of stress for millions. Financial advisers see clients who actually have so much money they’ll never outlive it. Nevertheless, these same rich folks may have so much anxiety about money they can’t even buy their grandchild a birthday present, Newcomb says.

When you feel in control of your money, your stress ebbs. Lower stress leads to better sleep, a better quality of life, better relationships — all benefits you get even without having more money, Newcomb says.

“When you’re stressed out, you may get sick, miss work, lose your job and get caught in a poverty trap because you feel you can’t afford life,” Newcomb says. “When we feel the power we have, when we take one little step forward, instead of stress we end up in a positive feedback loop.”

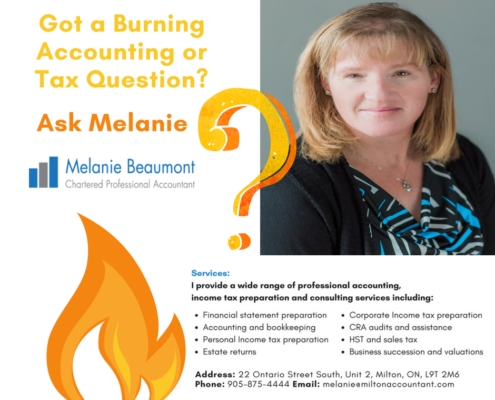

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!