#AskMelanie: How can I plan make my estate easy for my executor to manage?

If you could leave your estate in great in order to reduce the amount of stress to your loved ones (and the executor) wouldn’t you want to? This blog post from the Bean Counter shares how a father’s special planning did just that.

If you could leave your estate in great in order to reduce the amount of stress to your loved ones (and the executor) wouldn’t you want to? This blog post from the Bean Counter shares how a father’s special planning did just that.

Lynne Butler, of Estate Law Canada blog fame, had a blog titled “What my father’s death taught me about estate planning.” What was interesting about this blog post, is that Lynne essentially got out of the way and just said you have to read this amazing article. I wondered why Lynne had so little to say until I actually read the guest post on the Getting Rich Slowly blog. Essentially, Jody (the guest poster) relayed how her father planned while he was alive, to make her job as an executor as stress-free as possible. If there was ever a selfless act of love in a financial sense, this is it.

This blog was of particular interest to me as I have written several blogs on this topic: Where are your Assets, Speak to your Executor-surprise only works for birthday parties, not death and You Have Been Named an Executor Now What. Like Lynne, I was amazed at how much thought Jody’s father put into his estate. This contrasts with the average person, who often does not even inform their executor that they have been named, let alone provide a roadmap that can be followed once they are gone.

In her guest blog, Jody discusses the steps and actions her father undertook while he was alive to minimize the fees associated with administering his estate, and just as importantly, to keep the process as stress-free for his daughter as possible. While I cannot do Jody’s guest blog justice (you really should open the link above and read it), the following is a summary of some of the steps her father took to ensure he minimized Jody’s stress in administering his estate.

To help assist in administering your estate, you may wish to download the BDO Estate Organizer so that you have a detailed document for your family and/or executor. You can link to the estate organizer and download the document here.

Professional team

Jody’s dad not only built a team of advisors – a banker, accountant, insurance agent and lawyer – but he also ensured that he introduced his daughter to each of these advisors while he was alive and ensured that she had their contact information. Think about how smart that was. How much easier is it to communicate and work with someone you can put a name and face to?

Fees

Jody’s dad negotiated the estate fees with his lawyer down to 2% from the typical 4-5%. One can easily see why the lawyer accepted the lower fee. Jody’s father was so organized; the estate probably took one-quarter of the time most estates need to settle. Not only did he negotiate the fee, but he also put those fees aside in a separate account.

Joint Accounts

Jody’s father added Jody to his bank accounts, which allowed her to seamlessly pay bills. As Jody is American and there are no probate fees in the U.S., this was not done for probate purposes, but only for easing the administration of the estate for Jody. See my blog on Joint Bank Accounts Documenting your Intention, to understand some of the issues of using joint bank accounts in Canada.

Preparing for death

Jody’s father pre-paid his funeral expenses and even had a master binder that included funeral instructions – he told Jody to go to “F” for Funeral in his binder. Jody essentially had nothing to do but follow instructions.

In addition, her father left extra money for miscellaneous expenses that always arise on an estate. The extra money, whether left in a joint accounts or actually just given to a responsible child, is very important in Canada. The banks will typically pay for the funeral expenses and the probate fees, but access to the funds for any other expenses can be problematic until probate is authorized. Consequently setting aside funds so your executor will not need to beg the bank for access to accounts is a great idea.

Executor Fees

When Jody’s father informed her she would be named executor and he offered compensation, she, like many children, declined because she did not feel that she should charge her father.

However, after undertaking the executor’s job, Jody had this to say: “After he passed away and I realized all that it entailed, I found myself thinking that maybe I should have taken him up on that offer. Being the executor of an estate — even a very well-planned estate — took about 10 to 15 hours a week for months. It’s a big job. I found myself resenting my brothers since I was doing it all.”

The above is a very insightful and honest comment and is the reality in many estates. Jody’s father showed even more insight when he disregarded Jody’s protestation on accepting an executor fee as he had arranged to give her 1% extra when his IRA was distributed.

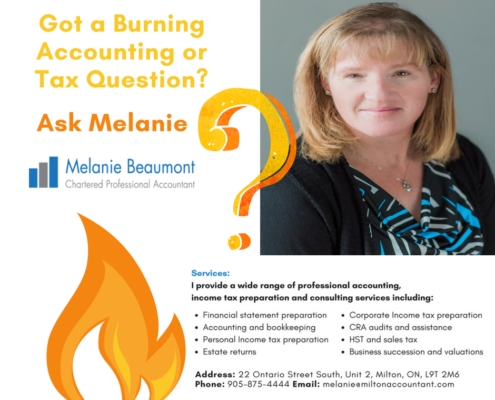

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!